Further, each MSB (including each MSB employee) is protected from civil liability for any SAR filed by the MSB. MSBs (including MSB employees) are prohibited from disclosing to a person involved in the transaction that a suspicious activity report has been filed.

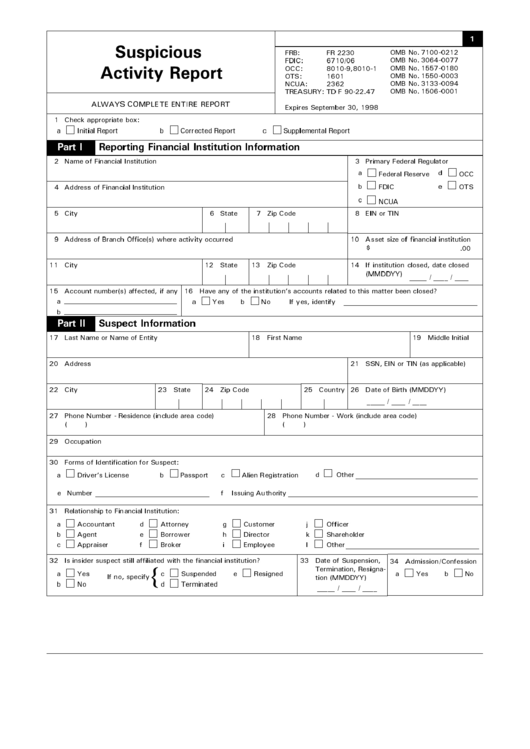

A copy of the filed form and supporting documentation must be retained for a period of five years from the date of filing.ĭisclosure Prohibited. MSBs have 30 days after becoming aware of a suspicious transaction to complete and file the form. A SAR must be filed using a SAR MSB form. Serves no business or apparent lawful purpose, and the reporting business knows of no reasonable explanation for the transaction after examining all available facts.įiling.

0 kommentar(er)

0 kommentar(er)